Consider these factors when aiming to propel the next generation of food and beverage products in Thailand

An aging population continues to drive the surge in demand for health and wellness products as the post-pandemic effect takes place resulting to greater market penetration for many health and wellness products. 1

On the other hand, the younger generations’ increasing consciousness & high familiarity of certain functional ingredients helps to catapult the growth in demand of functional products such as plant-based protein beverages as weight control which has become the utmost concern for the younger generation.

As the pandemic ends, Thai consumers began to enjoy life outside of the house again and it is notable that the change in behaviors results to the change in people needs in terms of the benefits that consumers expects when purchasing a certain food & beverage product. Certain matters such as the likes of immune related benefits have started to decline while protein, plant-based and skincare have taken the top spot among many Thai consumers.1

The dietary practices of Thai consumers have also accelerated the growth of health and wellness products on the market as more Thais are focused on adding nutritious components to their diet instead of limiting certain nutritional choices such as high processed food etc. 1

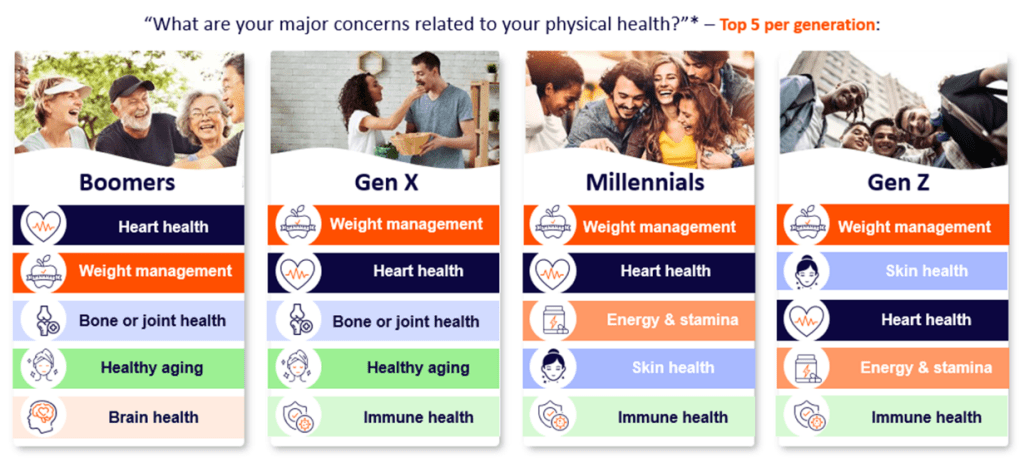

Figure 1: The global trend of major health concerns among different generations (Innova, 2023)

Thai consumers are increasingly prioritizing healthy living through their dietary choices

The global trend shows that there are indeed differences in the major health concerns that are considered by different generations. Worldwide, the boomers generation shows a higher health concern in regards to heart health while Gen X, Millennials & Gen Z prioritizes weight management as their major health concern followed by heart/skin health concerns. This worldwide shift in health concerns is a reflection of the increasing affordability concerns and limited time as key barriers when trying to consume healthier options. 2

Therefore it is also no coincidence that the global health concern trends is also a reflection of many of Thai consumers’ major concerns. According to Mintel, 38% of Thai consumers adopts healthy living to improve physical performance while 28% do so out of mental wellbeing concerns. 2

Interestingly, although many Thais agree to adapt healthy diet practices, many Thais are unsure of which healthy living is considered as additive rather than restrictive. 70% of Thais considers fruits and vegetables as good health habit while only a low 21% says the same for cutting/limiting animal consumption. 2

What is quite compelling however is that nearly a quarter of Thais (24%) sets a goal to switch from consuming animal-based products to plant-based diet which means that for brands who can optimize this growth in trend should see significant growth in the market.

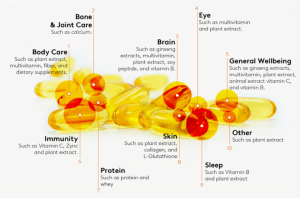

Figure 2: The functional products in Thailand market with different product segmentations 3

Body care & General wellbeing remains top of mind among a lot of Thai consumers

As evident from the second figure, many Thai consumers still prioritize body care as post Covid-19, many consumers started to be more active in outdoor activities such as going to work & exercising, protein and body care focused products beings to recover.

Interestingly, the rebound in protein products within the Thai market also drives a new market trend in the rapid growth of plant-based protein products across many OEM manufacturers as plant-based protein products are in line with the desire of many Thai consumers to shift towards plant-based eating.

General wellbeing is also seeing a growth in demand as many Thai consumers becomes more proactive in consuming different ingredients such as multivitamin, plant extract as well as vitamin supplements. There is also no deny that immune health & general wellbeing remains as top of mind among Thai consumers when deciding to purchase supplements.3

Intriguingly, on top of the large focus on body care & general wellbeing, skin focused products still sees a strong performance as it remains as the second most popular product as most of these products will come in powder format which can be produced in affordable size or sachets. 3

How dietary fiber plays a major role in shaping up the dietary choices of Thai consumers

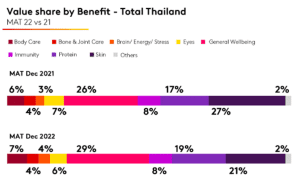

Figure 3: How high fiber-high protein diet (HPF) using FiberCreme can be beneficial to control weight management in comparison to high protein diet (HPD) alone.4

With many Thai consumers largely focusing on weight control, plant based as well as general wellbeing, dietary fiber becomes one of the most fundamental functional ingredient for many Thai consumers. Beyond its conventional use in gut health-related products like yogurt, fiber has found applications in a broad spectrum of products, ranging from functional beverages to meal replacement products.

Despite the various health benefits, there are still gaping holes among many dietary fiber products that can leave many consumers feeling unsatisfied. Several factors such as low tolerate dosage that can result to the side effects of bloating or laxative effects, unverified health benefits as well as the typical bland taste can drive away consumers to consume dietary fiber products.

Addressing the evolving demand for dietary fiber in various applications, LNK introduces FiberCremeTM, a distinctive unique prebiotic designed to meet the requirements of manufacturers and bridge existing gaps in dietary fiber options. This innovation aims to contribute significantly to the evolving landscape of dietary fiber utilization.

FiberCremeTM brings a new portrait to the world of dietary fiber as it is high in dietary fiber but have a unique creamy taste profile which means it is able to enhance the taste profile of many food and beverage products. Moreover, FiberCreme is well tolerated up to 50-60 g/day with minimal risk of laxative effects for consumers. We also aim to prove the health benefits that FiberCreme brings through the various scientific clinical studies which has been published internationally.

FiberCreme

As the third figure shows, one of FiberCreme’s clinical study shows that the combination of high protein-high fiber diet using FiberCreme can result to better weight control performance as it resulted to a more significant reduction of body weight loss, body mass index & body fat percentage in comparison to consuming high protein diet only. 4

This result is beneficial for manufacturers who are exploring to create functional products that contains high protein and with the combination of FiberCreme, it can prove to be a formidable combination that results to better weight management control. Moreover, FiberCreme is beneficial to act as masking agent in plant-based products or when combined with plant-based protein sources as it helps to mask “beaniness” or “nuttiness” that often arise in these products. 4

For further insights on how FiberCreme can enhance the value of your products, we encourage you to reach out through our website. Explore a collection of whitepapers on FiberCreme developed for diverse applications to gain comprehensive knowledge about its versatility and benefits.

Yogurt – https://www.business.fibercreme.com/application/dairy

Meal Replacement – https://www.business.fibercreme.com/application/health-nutrition

Fruit Juice – https://www.business.fibercreme.com/application/dairy-alternatives

References:

- Pongsanguan J (2022). Thai Consumer Behavior 2022. Mintel

https://www.mintel.com/insights/consumer-research/thai-consumer/#download

- Mintel (2023). https://www.mintel.com/press-centre/thai-consumers-seek-value-added-drinks-amidst-soaring-temperatures/

- Dheeraphongs M (2023). Thai consumers seek overall well-being and immune support in the supplement market https://www.kantar.com/inspiration/fmcg/thai-consumers-seek-overall-well-being-and-immune-support-in-the-supplement-market

- Hendi Wijaya (2022). The combination of isomalto-oligosaccharides (IMO)-based dietary fiber and hypocaloric high-protein diet could improve the anthropometric profile and fasting plasma glucose of healthy adults: A repeated single-arm clinical trial